Charitable Planning Strategies for the Fragile Decade

As our clients at McLean Asset Management near retirement, we notice that many do not bring up charitable gifting strategies to help optimize their retirement plans. Perhaps it’s a focus on solving the longevity goal of making sure there is enough money to meet yearly expenses exclusive of other goals, or perhaps it’s skepticism or uncertainty about charitable gifting strategies in general. Whatever the reason, these strategies are not top of mind. Because of this and the fact that we are nearing year end, we thought it helpful to highlight a few charitable planning strategies and broadly discuss how they might benefit your overall retirement plans. Rather than promoting a specific strategy or forcing a specific cause on a client, in this article we will first discuss the basics of charitable planning and then introduce more sophisticated strategies like Charitable Remainder Trusts and Charitable Gift Annuities.

The History of Charitable Deductions

The history of the charitable tax deduction is interesting. At the beginning of World War I, income taxes were raised to help pay the costs of the war and as a result, charities began to suffer. The top tax rate went from 15% in 1916 to 67% in 1917. To help charities survive, Congress passed the War Revenue Act of 1917 which incorporated an income tax deduction, based on charitable contributions. Since then, there have been variations on the charitable deduction, but the concept has remained a key component of the tax code.

Assuming you itemize your tax return, a charitable gift today will receive a tax deduction based on the fair market value (FMV) of the gift subject to adjusted gross income (AGI) limitations. In 2018, you can deduct up to 30% of your AGI if the gift is an appreciated security and up to 60% of your AGI if it is a cash gift. If you exceed these limits, you can carry forward your deduction up to five years. A charitable gift will also remove the asset from your estate, possibly minimizing estate taxes, and capital gains are avoided on the gift. In some cases, a charitable gift can generate a stream of income that a retiree can use to help manage retirement.

A caveat before we get into specific strategies: the devil is in the details, not only with the strategy itself, but also with how it relates to your own tax and retirement situation. With that in mind, we suggest that before any of these highlighted strategies are implemented that you review them with your advisor or CPA to make sure they fit your situation.

Highly Appreciated Securities

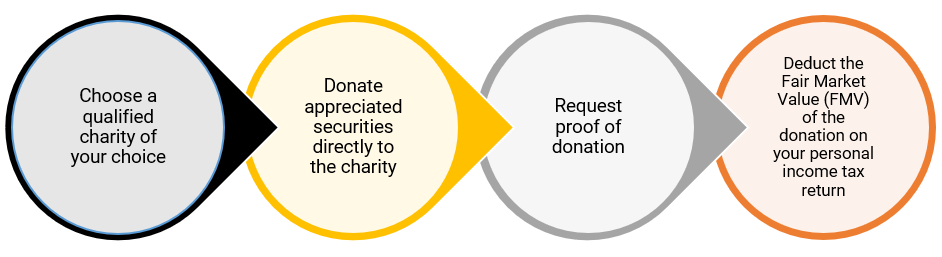

The simplest charitable strategy is to gift a highly appreciated security. Here is how the process works:

Ideally, you want to gift low-cost-basis stock to avoid tax on the gain of the sale of the stock. In the example below, there is a $2,400 tax savings when donating $10,000 stock with a cost basis of $2,000 versus writing a check for $10,000. Here is an overview of the tax savings of gifting low-cost-basis stock versus giving cash:

| Sell stock and donate $10,000 cash | Donate $10,000 of stock directly | |

| Ordinary income tax savings (Assumes 35% tax rate) | $3500 | $3500 |

| Capital gains tax savings (Assumes 15% tax rate on $8,000 gain) | ($1200) | $1200 |

| Total tax savings | $2,300 | $4,700 |

| Net cost of charitable gift (Fair Market Value (FMV) – Tax savings) | $7,700 | $5,300 |

An additional benefit of this strategy is that it helps diversify your existing portfolio by lessening concentrated positions.

The Bunch and Skip Strategy

Because of the Tax Cut and Jobs Act of 2017 (TCJA), the charitable landscape has changed the tactics of this basic strategy. A key impact of the TCJA is that 90% of tax filers will no longer itemize because the standard deductions have been raised to $12,000 for an individual and $24,000 for a married couple. And, importantly, you must itemize to receive a financial benefit from a charitable gift, except for the Qualified Charitable Distribution (QCD) which we discuss later. This has led to the popularity of the “bunch and skip” gifting strategy. The idea behind this strategy is to make sure you exceed the standard deduction threshold so that you receive a tax deduction from your gift. To do this, you bunch your planned gifts into one year and skip gifting in subsequent years. For example, if you plan to gift $10,000 a year for five years, you may be in a situation where you do not exceed the standard deduction in each of these five years. However, if you front load your five-year contribution into one year, a $50,000 gift for example, then you will be able to deduct the $50,000 against your income in the current year. To meet your plan, you can then skip charitable giving the next four years. This is an ideal strategy for someone who is still working and earning a high income and plans to retire in a couple of years.

Donor Advised Funds

The “bunch and skip” gifting strategy has increased the popularity of Donor Advised Funds (DAF). A nice thing about the DAF is you can front load your gift and receive a charitable deduction in the current year while doling out the funds to the specific charity in the following years. Another benefit is that you can invest these funds with the possibility of increasing the value of your charitable fund. There are many Donor Advised Funds available in the marketplace from brokerage firms like Fidelity, Schwab, and Vanguard. Community foundations also have Donor Advised Funds available.

Qualified Charitable Distributions (QCD)

Before we move on to income-producing charitable gifting strategies that will optimize your retirement plans, we should mention the Qualified Charitable Distribution (QCD). A QCD allows up to $100,000 of your Required Minimum Distributions (RMD’s) from your IRA to be distributed directly to a charity without any tax consequences. To be clear, you do not receive a tax deduction with this strategy. The main benefits of the QCD is that that you don’t have to worry about itemizing to obtain a financial benefit from the gift and the income from your RMD does not increase your AGI and possibly negatively impacting other parts of your return.A question we often receive is which one is better, donating appreciated securities or a QCD? In most cases, it is better to donate appreciated securities because you permanently avoid capital gains on the donated securities and receive a tax deduction. However, there are cases where the QCD is advantageous. For example, it is better to take a QCD if you don’t itemize. Or, you may be waiting to receive a step up in basis on your stock at your death, making the avoidance of capital gains not as valuable. Which is best will depend on your specific situation.

Charitable Remainder Trusts and Charitable Gift Annuities

Now, to income-producing gifting strategies. We will start with Charitable Remainder Trusts (CRT’s). A CRT offers the following benefits to a retiree:

- A CRT helps pensionize an asset by establishing an income stream (around 5% of the value of the asset).

- A CRT provides a charitable tax deduction. While the deduction is not 100% of the market value of the gift, it can be significant. The exact amount is determined by current interest rates and the structure of the CRT.

- A CRT helps diversify a portfolio because you can donate a concentrated position and then diversify the position once it is in the CRT.

- A CRT avoids capital gain tax imbedded in the donated security.

- A CRT removes remainder value from your estate.

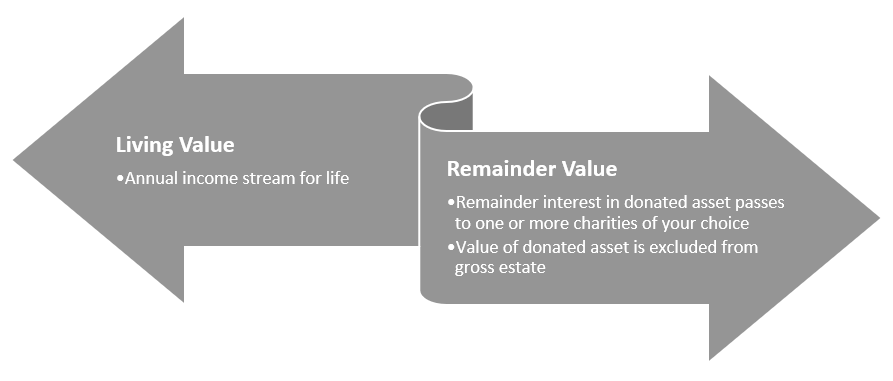

The reason you obtain these benefits is that you “split” the asset into two parts: the living value and the remainder value. This is illustrated below: There are many variations on this basic concept including CRAT’s (Charitable Remainder Annuity Trust), which pay out a fixed amount each year and additional contributions are not allowed. In contrast, CRUTS (Charitable Remainder Uni Trusts) distribute based on an annual review of the market value and additional contributions can be made. NIMCRUTS (Net Income with makeup CRT) allow you to have lower income payments during the first years of the CRT and then move the payout to a higher amount in future years. Which one works for you will again depend on your specific situation.

There are many variations on this basic concept including CRAT’s (Charitable Remainder Annuity Trust), which pay out a fixed amount each year and additional contributions are not allowed. In contrast, CRUTS (Charitable Remainder Uni Trusts) distribute based on an annual review of the market value and additional contributions can be made. NIMCRUTS (Net Income with makeup CRT) allow you to have lower income payments during the first years of the CRT and then move the payout to a higher amount in future years. Which one works for you will again depend on your specific situation.

In today’s interest rate environment, a 5% draw is a reasonable assumption with a CRT. This income is taxable based on a tier schedule of what is being distributed-capital gains versus interest as an example. Because of attorney costs, a minimum of $250,000 or perhaps more should be considered before considering a CRT. There are additional nuances to CRT’s beyond the scope of this article, but to simplify, a CRT should be considered when you need income either for yourself or your beneficiaries, have a concentrated position with a significant gain, need to minimize estate taxes, would like to receive a tax deduction, and you have charitable intent.

If you don’t exactly meet the criteria for a CRT or are looking to donate less than $250,000, then a Charitable Gift Annuity (CGA) is another strategy to consider. A CGA is a contract between a donor and charity. You donate to the charity and the charity will pay you income for life based on your age. A CGA is similar in concept to a commercial annuity, but it is backed by the charity and not the insurer. In most cases, the CGA will offer a lower rate of return on the income stream because of the tax deduction. The income is not adjusted for inflation. Some of the income will be a return of principal and some of it will be taxed as ordinary income depending on what is gifted. In today’s market, we have seen rates around 4 ½ % for a sixty-five-year single life Charitable Gift Annuity. This compares to a commercial annuity of about 5.6%. Another key factor to consider is the financial strength of the charity and their ability to their financial obligations.

We hope the above gives you a starting point to think about how planned giving will complement your retirement and philanthropic goals. We will write in more detail about some of the strategies mentioned above in future articles, but in the meantime, please feel free to reach out to your advisor to discuss these strategies and how they may fit your situation.

McLean Asset Management Corporation (MAMC) is a SEC registered investment adviser. The content of this publication reflects the views of McLean Asset Management Corporation (MAMC) and sources deemed by MAMC to be reliable. There are many different interpretations of investment statistics and many different ideas about how to best use them. Past performance is not indicative of future performance. The information provided is for educational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy or sell securities. There are no warranties, expressed or implied, as to accuracy, completeness, or results obtained from any information on this presentation. Indexes are not available for direct investment. All investments involve risk.

The information throughout this presentation, whether stock quotes, charts, articles, or any other statements regarding market or other financial information, is obtained from sources which we, and our suppliers believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission there of to the user. MAMC only transacts business in states where it is properly registered, or excluded or exempted from registration requirements. It does not provide tax, legal, or accounting advice. The information contained in this presentation does not take into account your particular investment objectives, financial situation, or needs, and you should, in considering this material, discuss your individual circumstances with professionals in those areas before making any decisions.